There are millions of payroll software outside the world but which one will you choose and which one will be right for you small business or startups?

In today’s digital era, manual payroll processes have become a thing of the past, especially for startups. Employers are increasingly turning to automated payroll systems to streamline salary payments for their employees.

What is payroll software for startups?

Starting a business is exciting, but managing payroll can quickly become a headache. With countless payroll software options available, selecting the right one can feel overwhelming. But worry not! This guide will help you navigate the options and find the perfect fit for your startup.

These systems not only save time and effort but also minimize errors and ensure compliance with regulations. With payroll software tailored for startups, managing finances becomes seamless, allowing businesses to focus on growth and innovation. Embracing automated payroll solutions enhances efficiency, accuracy, and overall employee satisfaction. Say goodbye to manual payroll hassles and hello to the future of streamlined financial management.

5 best software providers in payroll for startups?

1.OnPay

Payroll for startups: Best overall all-in-one payroll and HR solution.

In the dynamic landscape of startups, efficiency is key to success. Managing payroll can be a time-consuming task, but with the right tools, startups can streamline the process and focus on growth. Here’s how innovative payroll solutions can revolutionize payroll management for startups:

1. Full-Service Payroll:

Startups can now pay their teams in record time, thanks to full-service payroll solutions. With just a few clicks or taps, hours can be entered, reviewed, and approved for each pay run. This streamlined approach ensures that payroll tasks are completed efficiently, even on mobile devices, freeing up valuable time for startup entrepreneurs to concentrate on core business activities.

2. Automated Taxes:

Tax compliance can be a daunting aspect of payroll management, especially for startups navigating complex regulations. However, automated tax solutions offer peace of mind by handling all federal, state, and local taxes accurately. With the assurance of guaranteed calculations and access to expert support from seasoned professionals with over 30 years of payroll experience, startups can confidently avoid costly mistakes and save valuable time.

3.Accounting Integrations:

Say goodbye to the hassle of double data entry with seamless accounting integrations. These integrations, particularly with industry-leading platforms like QuickBooks and Xero, enable startups to consolidate their financial data effortlessly. By syncing payroll information with accounting software, startups can maintain accurate records, streamline reporting processes, and ensure financial transparency.

By embracing these cutting-edge payroll solutions tailored for startups, businesses can unlock significant benefits. From increased efficiency and accuracy in payroll processing to simplified tax compliance and seamless integration with accounting systems, startups can leverage technology to optimize their payroll management processes. With more time and resources freed up, startups can focus on innovation, growth, and achieving their business objectives.

2.Gusto

Payroll for startups: Best for contractor payroll.

In the fast-paced world of startups, every moment counts. Managing payroll efficiently is crucial for smooth operations and employee satisfaction. Gusto emerges as a beacon of efficiency, offering startups a seamless solution tailored to their unique needs.

1. Automated Payroll and Taxes:

With Gusto, startups can bid farewell to the complexities of manual payroll processing. Contractors can self-onboard swiftly online, ensuring they’re ready to contribute from day one. The automated payday emails and 1099-NEC forms streamline communication and compliance, eliminating the hassle of chasing signatures or fretting over misplaced paperwork. Gusto takes care of all tax forms and calculations, providing peace of mind to startup owners.

2. Transparent Pricing:

Startups thrive on clarity and transparency, and Gusto delivers just that. The pricing structure is straightforward, with every plan including contractor payments at the same per-person fee as for employees. There are no hidden charges for essential features like direct deposit, tax filing, or pay stubs. Moreover, Gusto offers flexibility with a Contractor Only plan, ideal for startups without W-2 employees. Startups can save even more with Gusto, as contractors aren’t charged in months when they’re not paid.

In the dynamic landscape of startups, Gusto stands out as a reliable ally, simplifying payroll management and empowering entrepreneurs to focus on their core objectives. By automating tedious tasks and providing transparent pricing, Gusto enables startups to allocate their resources efficiently and foster a culture of trust and transparency within their workforce. With Gusto at their side, startups can navigate the complexities of payroll with ease, ensuring smooth sailing towards success.

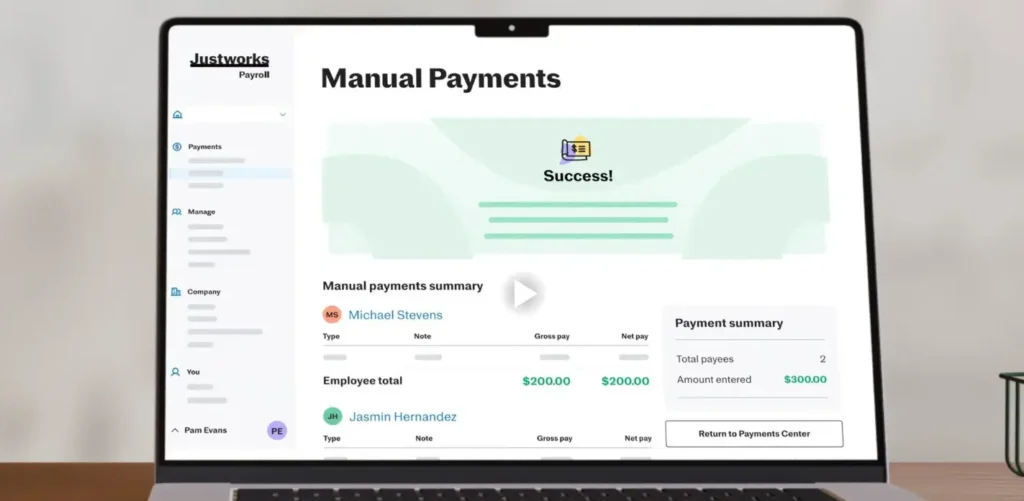

3.Justworks

Payroll for startups: Best for professional employer organization (PEO) services.

1. Payroll Services:

For startups navigating the complexities of managing payroll, efficiency is key. Our payroll services offer a seamless solution, allowing startups to run payroll effortlessly and reliably. With unlimited payroll runs, the process becomes smoother, requiring less effort from your team. Our user-friendly online software simplifies payment processes for both employees and contractors, automating payments and providing options for one-time payments. Moreover, issuing year-end tax forms such as W-2s and 1099s becomes a breeze. With features like payroll forecasts, startups can make more accurate financial projections, aiding in budgeting and planning for growth.

2. HR Tools:

Startups often wear multiple hats, and managing human resources can be time-consuming. Our integrated HR tools complement our payroll solution, offering startups easy-to-use features for efficient people management. From streamlined employee onboarding to simplified PTO management, these tools save valuable time and resources. Additionally, our expert support team is readily available to assist with any HR-related queries, ensuring startups can focus on their core business activities while we handle the administrative tasks.

3. Integrated Benefits Add-On:

Attracting and retaining top talent is crucial for startups, and offering competitive benefits can make all the difference. With our integrated benefits add-on, startups can provide access to flexible medical, dental, and vision plans that fit their team and budget. This option enhances the startup’s appeal to prospective employees, showcasing a commitment to their well-being and job satisfaction. Whether selecting plans from national carriers or integrating existing ones, startups gain the flexibility to tailor benefits to their unique needs, supporting their growth and success.

4. Integrated Time Tracking Add-On:

Time management is essential for startups seeking efficiency and productivity. Our integrated time tracking add-on offers a seamless solution, simplifying timekeeping for startup teams, whether they’re remote or in-office. Employees can easily track their time online or via our mobile app, ensuring accuracy and compliance. With features like overtime monitoring and direct syncing with payroll software, startups can confidently manage employee time, staying compliant with regulations while optimizing productivity.

This comprehensive suite of services empowers startups to streamline their payroll, HR, benefits, and time tracking processes, allowing them to focus on what truly matters—building and growing their business.

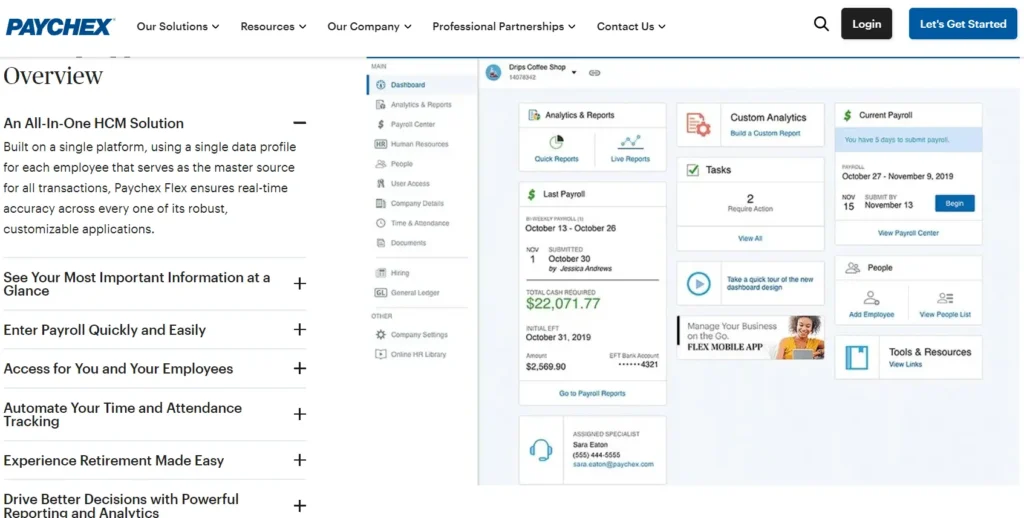

4.Paychex Flex

Payroll for startups: Best for simplicity.

1. Payroll Services Made Easy:

Pay your people in just a few clicks through an easy-to-use online payroll software with flexible processing, automated tax administration, and employee self-service that can adapt to your changing needs.

2.Paychex HR Services

- Proactive HR advice helps you focus on your business

- Valued benefits help you attract and retain talent

- Compliance support keeps you aware of laws and regulations

- All-in-one HR technology simplifies employee management

3. Paychex Flex® Software Integrations

Our APIs Connect Popular HR, Productivity, and Financial Tools.

As your company grows and changes it’s important that your software can automatically and accurately connect and share data. Our continually expanding API library offers software integrations the way you need them — two-way and flat-file — to make it easier for you to hire, manage, pay, and retain your employees.

This comprehensive suite of services empowers startups to streamline their payroll, HR, benefits, and time tracking processes, allowing them to focus on what truly matters—building and growing their business.

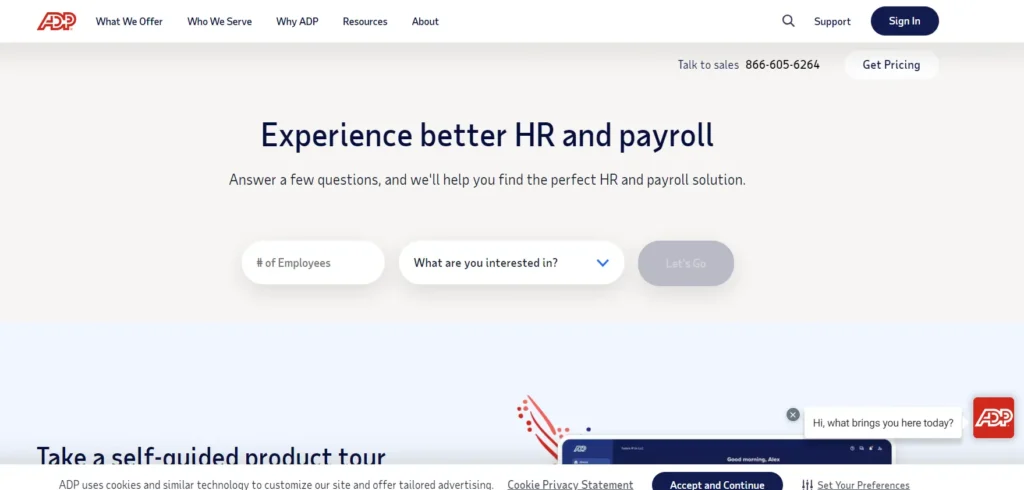

5.ADP RUN

Payroll for startups: Best for payroll tax compliance.

1.End HR compliance confusion:

For small businesses, HR mistakes can be costly, putting you and your business at risk for expensive fines and penalties. If you’re like most small businesses, you can’t afford the risk.

Small business HR compliance solutions include:

- Live HR support

- Employee handbook wizard

- Proactive compliance alerts

- HR guidance and forms

- Employer/employee training

- Legal assistance from Upnetic Legal Services®2

2. Pay your team seamlessly

It’s not easy running a small business. We’re here with payroll and tax solutions to support your needs anytime, anywhere.

Small business payroll solutions include:

- Process payroll in minutes, at your desk or on the go — or just set it to autopilot

- Payroll taxes calculated, deducted and paid automatically for you

- Quarterly and annual reporting done for you

3. Build your small business dream team

ADP makes it easy to win the war for talent with solutions to help you find the best candidates and track the hiring process efficiently.

Small business talent solutions include:

- Post open positions to over 100 leading job boards with one click from our platform using ZipRecruiter®1

- Easily manage, screen and quickly identify top candidates – all in one place

- Understand how changing regulations affect your business

How to Choose a Payroll Software Tool for Your Startup?

First, consider your needs. Do you have a small, remote team, or a larger, on-site workforce?

Look for software that scales and integrates with your existing tools. Features like automated tax filing and benefits administration are gold for busy startups.

Best Software features to use in payroll for startups ?

Payroll Software

Payroll software is an on-premises or cloud-based solution that manages, maintains, and automates payments to employees. Robust, integrated, and properly configured payroll software can help organizations of all sizes maintain compliance with tax laws and other financial regulations, and reduce costs.

For Accountants

Maintaining Accurate Records of Payroll Transactions

Accountants need to maintain accurate records of payroll transactions, including compensation, taxes, and deductions. They also need to ensure that the records are properly organized and accessible for audits and regulatory requirements.

HR Software

Payroll software is an on-premises or cloud-based solution that manages, maintains, and automates payments to employees. Robust, integrated, and properly configured payroll software can help organizations of all sizes maintain compliance with tax laws and other financial regulations, and reduce costs.

Rippling is the best HR software for midsize companies. BambooHR is the best HR software for small businesses. Gusto is the best HR software for startups.

Health Insurance

A health insurance policy is a contract between the insurance company and an individual. The individual pays a premium to the insurer and the insurer offers financial protection against healthcare expenses to the individual in return.

401(k) Retirement

A 401(k) is a feature of a qualified profit-sharing plan that allows employees to contribute a portion of their wages to individual accounts. Elective salary deferrals are excluded from the employee’s taxable income (except for designated Roth deferrals). Employers can contribute to employees’ accounts.

Software Integrations

Payroll integration refers to the strategic alliance between payroll software and various tools and software applications. The primary objective is facilitating automated data exchanges and synchronization, transcending traditional manual processes.

Conclusion:

- Choosing the perfect payroll software isn’t just about ticking boxes; it’s about igniting your startup’s growth engine. Imagine a world where payroll becomes effortless, freeing you to focus on your groundbreaking ideas. With a plethora of innovative solutions designed for startups, this world is within reach.

- Stop picturing mountains of spreadsheets and tax headacheṣs. Forward-thinking software streamlines operations, automates complex calculations, and ensures regulatory compliance. Let OnPay become your comprehensive payroll and HR partner, or leverage Gusto’s efficiency for seamless contractor payments. Justworks can even provide integrated PEO services, taking the burden of payroll entirely off your shoulders.

- These cutting-edge solutions empower your team. Imagine the boost in employee satisfaction when they can access pay stubs and manage benefits with ease. By embracing the right payroll software, you’re not just managing payroll, you’re fueling a culture of focus and productivity.

- So, ditch the manual processes and embrace the future of payroll. With a solution optimized for your startup’s unique needs, you can confidently navigate the dynamic world of business ownership, knowing your payroll is under control. Now, get back to what truly matters – launching your revolutionary ideas into the world.

FAQ’s

Startups should consider scalability, ease of use, compliance features, integrations with existing tools, and cost-effectiveness when selecting payroll software. It’s crucial to choose a solution that can grow with the business and streamline processes efficiently.

Payroll software automates repetitive tasks such as calculating wages, processing payments, and generating tax forms. This automation saves startups valuable time and reduces the risk of errors, allowing them to focus on core business activities and growth strategies.

Reputable payroll software providers prioritize data security, employing encryption, multi-factor authentication, and regular security updates to safeguard sensitive information. Startups can also implement best practices such as strong password policies to enhance security further.

Most payroll software providers offer various support channels, including email, phone, and live chat support. Additionally, comprehensive user guides, tutorials, and knowledge bases are often available to assist startups in navigating the software efficiently.

Yes, payroll software typically includes features to help startups stay compliant with tax laws and regulations. Automated tax calculations, tax filing services, and updates to reflect changes in tax legislation are common features that assist startups in meeting their tax obligations accurately and on time.

Pingback: Top Audit Firms in India: How to select best for you?

Pingback: Zero Exit Load Mutual Funds: How to Choose Fund

Pingback: Which HR software is best for startups in 2024?

Pingback: What are the Functions of NSIC?

Pingback: Lessor vs Lessee: Key Roles in Lease Agreements

Pingback: KFC Franchise Cost in India 2024?

Pingback: A Complete Guide to Commercial Leases in India

Pingback: 200% Success Business Ideas with 1 Lakh in 2024 ?

Pingback: 5 startups in Chennai to know