A Beginner's Guide to Stocks, Commodities, Forex, and Trading

The world of finance can seem like a complex jungle, filled with unfamiliar terms and intimidating charts. But fear not, intrepid explorer! This guide will be your machete, hacking away the confusion to reveal the exciting world of markets and trading.

Understanding the Marketplace: Where Buyers and Sellers Meet!

Imagine a bustling marketplace teeming with activity. Here, producers (manufacturers) create products, distributors wholesalers them to retailers , who then sell them to the consumers (you and me!) This basic exchange of goods and services is the foundation of any market .

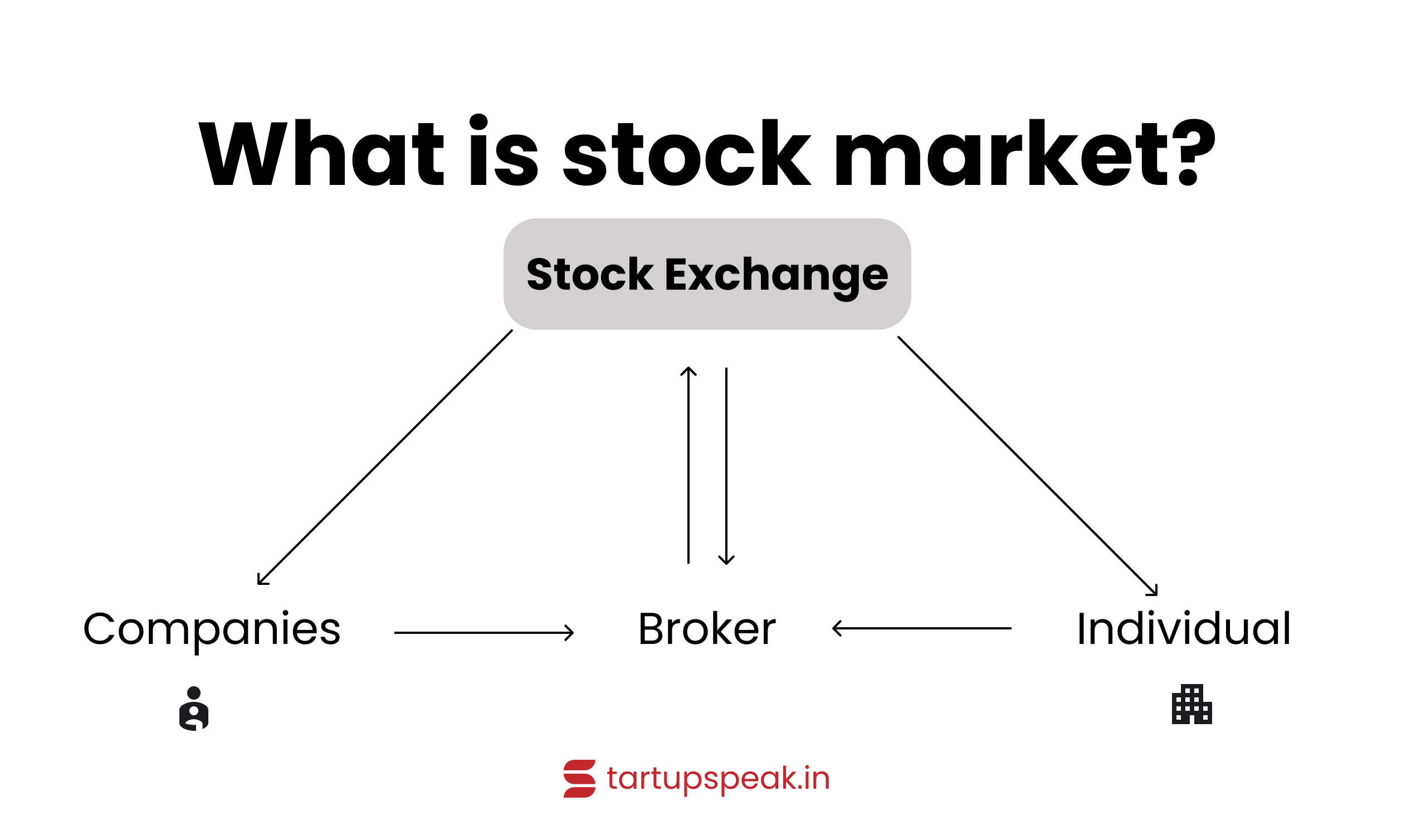

The financial market is a special kind of marketplace where you can trade things you don’t physically hold, like stocks (also called equities or shares). These represent a tiny piece of ownership in a company . So, if you buy a share of Apple, you become a part-owner of the tech giant (well, a very tiny part!).

Stock Market: Where to Find These Ownable Pieces? ️

Stocks are traded on special exchanges, like the National Stock Exchange (NSE) in India or the New York Stock Exchange (NYSE) in the US. These exchanges act as a meeting point for buyers and sellers, ensuring a smooth and transparent trading experience. Indian trading hours are typically 9:15 am to 3:30 pm , so plan your stock market adventures accordingly!

Beyond the Stock Market: Exploring Other Market Jungles ️

The financial market isn’t just about companies! Here are some other exciting territories to explore:

Commodity Market (MCX): Here, you can trade things like gold, silver, crude oil, and natural gas. Basically, anything a commodity trader can store and transport can be traded here ️

Foreign Exchange Market (Forex): This global marketplace is all about trading currencies. Imagine exchanging your rupees (INR) for US dollars (USD) for your next vacation. That’s forex in action!

Different Styles for Different Folks

Now that you know the lay of the land, let’s delve into the world of trading , where you can try to profit from price movements in these markets. But there’s no one-size-fits-all approach. Here are three main trading styles:

1.Day Trading: The Fast-Paced Thrill Ride

Day traders are like the cheetahs of the trading world. They make numerous short-term trades within a single day, aiming to capitalize on small price fluctuations. Think of it as a quick in-and-out adventure .

Pros:

- Potentially high profits in a short period

- Exciting and fast-paced

Cons:

- Requires a lot of focus and screen time ⏰

- Stressful – not for the faint of heart!

- High risk of losses due to rapid price movements

Day trading relies heavily on technical analysis , using charts and indicators to predict short-term price movements.

2.Swing Trading: Finding the Sweet Spot Between Speed and Patience

Swing traders are more like the gazelles of the trading world. They hold positions for a few days to a few weeks, aiming to capture medium-term trends in the market.

Pros:

- Less stressful than day trading

- Requires less screen time

- Offers good profit potential

Cons:

- May miss out on capturing very short-term trends

Swing traders often use a combination of technical analysis and fundamental analysis , which considers a company’s financial health and industry outlook.

3.Position Trading: The Long-Term Trek for Steady Gains ️

Position traders are like the elephants of the trading world – wise and patient. They hold positions for months or even years, focusing on long-term trends and company fundamentals.

Pros:

- Least stressful trading style

- Requires minimal screen time

Cons:

- Needs a lot of patience – results take time ⏳

- May miss out on short-term profits

Position traders rely heavily on fundamental analysis to make informed decisions.

Pingback: PhonePe Revenue Model in 2024: A Comprehensive Guide?

Pingback: A Complete Guide to Commercial Leases in India

Pingback: 200% Success Business Ideas with 1 Lakh in 2024 ?

Pingback: Here's how much Google CEO Sundar Pichai earned in 2024 ?